Are Hyperscalers Slowly Killing the Data & Analytics Market?

Analyzing Gartners Magic Quadrant for Analytics and Business Intelligence Platforms

It's no wonder, since hyperscalers are at the forefront of something like the Magic Quadrant (MQ) for Strategic Cloud Provider. This is exactly what they stand for on the market. We also see the incredible variety of topics and services that the hyperscalers are building. A more specific look on current Data & Analytics Magic Quadrants shows us, that there is an increase in importance of the hyperscalers here.

What happend in 2024

Hyperscalers have incredible resources to invest in these topics. Microsoft has shown how strong integration into an ecosystem can be and, in principle, best-of-suite, i.e. getting everything from a single vendor, is more attractive to many than best-of-breed. Managing the diversity of providers seems difficult to argue with as it is complex and expensive.

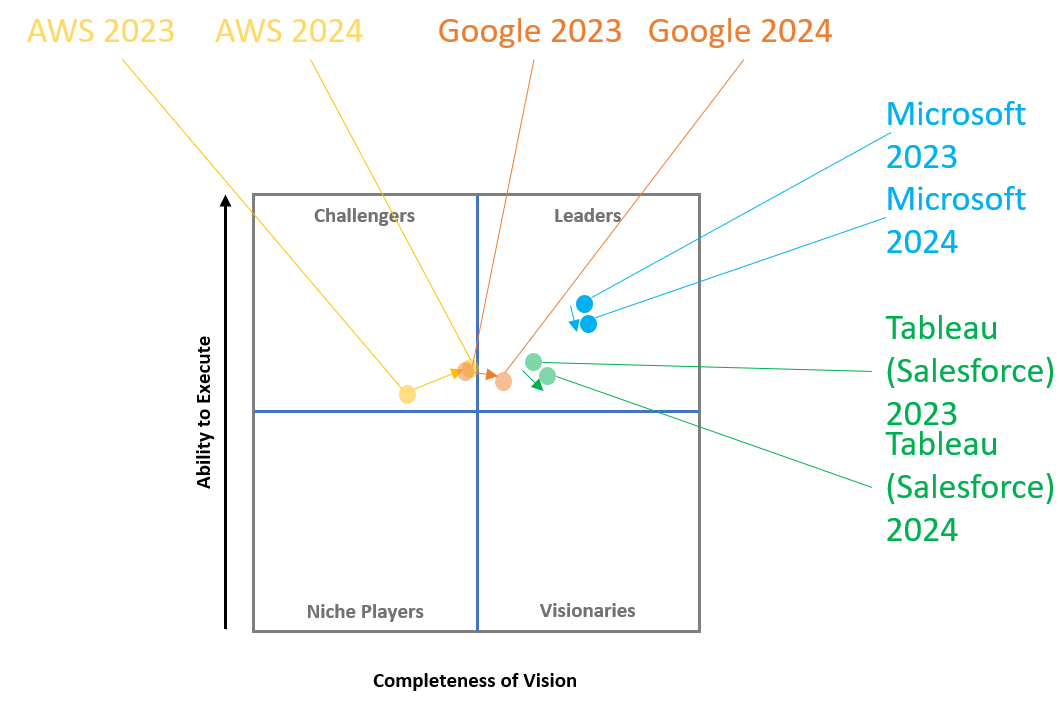

Let’s start with the Gartner MQ for Analytics and BI platforms and what changed from last year:

Fig. 1: Movements in the Gartner MQ for Analytics and Business Intellgence Platforms 2023 to 2024

First, Microsoft is in a dual position. Their Power BI dominates this MQ since years and at the same time Microsoft is one of the big three Hyperscalers. Possibly a role model for the others to go the same way. Even Google opened their semantic Layer LookML for Power BI. You can find Power BI nearly at every customer in the one or other form and the cost advantage if you already have Microsoft licences can be key. On top you can integrate into the Microsoft ecosystem like MS Office, MS Teams or MS Sharepoint like no other. Currently let’s observe in which direction Microsoft Fabric and the integration with Copilot goes and how this effects the further Power BI adaption.

Google entered this MQ for the first time with the acquisition of Looker in 2021. Google integrated Looker with Google Sheets, Google Slides and the Google data and AI stack to broaden usage and build the own ecosystem like Microsoft does. From 2023 to 2024 Google does the step from the Challengers quadrant to the Leader quadrant. What is remarkable here is, that Google opens their own semantic layer LookML to Tableau (Salesforce) and Microsoft Power BI and show also openess in many other areas. Being now already a leader there is still a lot of potential for Looker to grow.

AWS is and stays a Challenger in der Gartner MQ with their solution QuickSight. But look on the step they made and the Leaders quadrant is not far away. Compared to Microsoft and Google, it was build from scratch and while it can connect to different datasources it is strongly optimized for AWS services today. It is like most of AWS services, serverless and can be used for a good price.

Let’s have a look at the long-term leader Tableau, today part of Salesforce for comparison. Similar to the other strong leader Qlik, Tableau is not a standalone vendor for BI and Analytics anymore. While Tableau was always known for their strong community, being part of Salesforce brings possibly another focus today. Compared to Qlik, building a strong own data stack time will show how strong the focus on Salesforce is an will infuence the strong market position.

With 6 vendors just in the Leaders quadrant and 20 overall in Gartners Magic Quadrant 2024, this is an indicator that the market is huge and diverse today.

The Modern Data Stack is dead

The cloud made the Modern Data Stack (MDS) possible in the first place. Suddenly, compute power and the cloud data warehouse as the central core of a data stack, was available relatively easily and cheaply. New providers were able to develop their functionality like ELT, Transformation, AI, Data Orchestration, Reverse ETL, Analytics and so on, around it and customers were able to try out the interaction quickly and easily by only paying for what they really needed (pay-as-you-go). This has created an ecosystem that has shone through increasing partnerships and thus an improvement in integration.

What does this development mean for providers such as Databricks and Snowflake? They have long benefited from the hyperscalers, for which they have purchased vast amounts of resources on their platforms to support their functions. A win-win situation for a long time.

A major advantage of both providers is precisely the ability to be available on all of these and thus reduce the need to be tied to one provider.

But as shown, hyperscalers now provide an end-to-end data stack. The swan song of the MDS is no coincidence. Many players such as Databricks or dbt, which have benefited from the larger ecosystem, have expanded their functionality and no longer need these partnerships in a comparable way. And this, despite the dependencies to the hyperscalers.

What does this mean for Data & Analytics

There is a risk that this diversity could suffer in the coming years if there is a vendor lockout, in which the types of provision currently possible via hyperscaler marketplaces or partnerships become more difficult and more expensive. The ecosystem consists often out of small and few years old, venture capital feed vendors. If they can not differentiate enough in functionality, as the large players shows innovation at the same speed and getting problems being part of an optimized ecosystem with central partners, as they (Hyperscalers, Snowflake, Databricks) aren’t interested as before, diversity could sink and innovation could stagnate. The power of choice we always had will vanish. Maybe this is the way it should be while Data % Analytics becomes more and more commodity. Maybe AI makes everything obsolete in the next years.

What are your thoughts on the current development in the Data & Analytics market? What effects do you expect from the current momentum? A new wave of consolidations? Disruption through AI? New mega vendors rising offering strong end-to-end data stacks? Even new cloud providers challenging the domination of AWS, Azure and Google Cloud?

The analysis journey of the current D&A market based on Gartners MQ goes on:

Part 2: Data Integration Tools

Part 3: Data Science and Machine Learning Platforms

Part 4: Cloud AI Developer Services

Part 5: Cloud Database Management Systems